For the first time in 800 years the Welsh Government is raising money from taxes as the land transaction tax replaced stamp duty in Wales from April 1.

The Welsh Revenue Authority (WRA) – a tax authority for Wales – will have powers to collect and manage land transaction tax and landfill disposals tax, which replace stamp duty and landfill tax.

The WRA will be responsible for collecting tax revenue on behalf of the Welsh Government to support public services. The Welsh Government estimates the two new taxes will raise more than £1bn in the first four years, supporting the NHS, schools and social services.

Finance Secretary Mark Drakeford, said: “The introduction of these two new taxes represents a significant milestone for Wales.

The Welsh Revenue Authority (WRA) will be responsible for collecting Land Transaction Tax and a tax calculator is available on the WRA website.

The WRA website includes a handy calculator for you to see what you might pay under the new transaction tax. Land Transaction Tax Calculator

The WRA has also registered all Welsh landfill site operators who will file for landfill transaction tax from April 1. The WRA will work with Natural Resources Wales to collect and manage the tax.

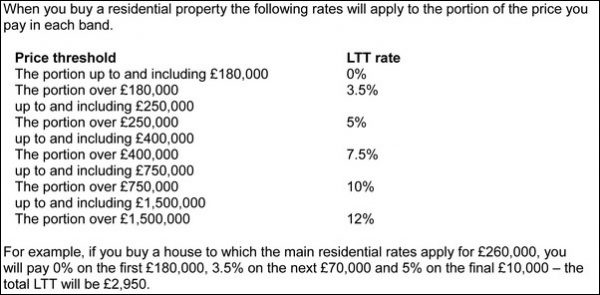

Land transaction tax will replace stamp duty land tax and will be paid on residential and non-residential property purchases or leases above a certain price threshold; landfill disposals tax, which is paid on waste disposed of at landfill sites, will replace landfill tax.

So for now buyers will be pay less stamp duty than those in England up to the value of £402’000 then it starts to be become more expensive to buy a house in Wales.